Executive Summary

Business Objectives

- Modernize the customer authentication experience with the latest technology

The Challenge

- Ensure an easy activation process

- Maintain a hybrid approach that offers maximum flexibility for their customers

The Solution

- Used OneSpan Mobile Authenticator Studio to create and deploy an independent software authentication app

The Results

- Cut new customer onboarding process from four days to five minutes

- Created a modern, convenient authentication experience

- Achieved a 95% adoption rate with new customers

EagleBank offers commercial banking services in Maryland, Washington D.C., and Virginia and has nearly $8.5 billion in assets. For over 10 years, the bank has relied on hardware authenticators for transaction authorization. When a commercial client performs a transaction, such as a wire transfer or ACH initiation, they must submit a one-time password (OTP) generated by the hardware authenticator. But in 2017, leadership determined that the time was right to migrate to a software authentication solution. As customers use their mobile devices for more and more banking services, the bank saw an increase in inquiries about software authentication. In response, EagleBank worked with partner FIS to deploy the OneSpan software solution in April 2018.

As EagleBank’s SVP, Digital Channel Product Manager explains, it is important for financial institutions (FIs) to stay ahead of the technology curve.

You need to show that you’re keeping up with the times. If customers don’t see certain functionality, they may think a little less of the bank as a whole. We are, at least for banks our size, more on the leader side than the follower.

The Challenge

New Technology and Existing Users EagleBank faced two key challenges in their software authentication deployment: determining the right launch strategy and forming a policy for their existing customers.

When FIs decide to migrate to a software authentication solution, they must choose whether to deploy the software authenticator as a standalone application or to integrate software authentication functionality into an existing banking app. Some FIs prefer one option over the other, usually for reasons unique to their own use case. OneSpan offers the flexibility to support both strategies.

For EagleBank, a standalone app proved to be the more straightforward approach, because the bank relies on a third-party developer to support their mobile app.

Those development resources were already committed to connecting the software authentication app with the existing banking app on a functional level. By choosing the standalone route, EagleBank was able to deploy the software authenticator more quickly while optimizing the resources they had available.

Another challenge for EagleBank was the question of the existing client base. After launch, EagleBank planned to offer their software authentication solution exclusively to new customers, but they had an existing pool of clients who still relied on the hardware authenticators. EagleBank strategized on the best methodology to educate and transition these existing clients onto the new technology.

Solution 1: Launch Strategy

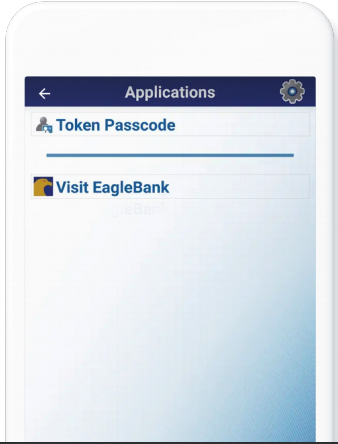

Launch Strategy EagleBank used OneSpan Mobile Authenticator Studio to create and deploy an independent software authentication app. Under EagleBank’s branding, the app was named the “EagleBank Soft Token App”, and features the bank’s logo and brand colors. This consistency in branding is important for several reasons. First, it helps the user locate and identify the app on the app store. Second, it promotes brand consistency. Users tend to have a higher level of trust when they know that it is an official EagleBank product.

The software authentication solution has several advantages over the legacy hardware devices. Customers do not need to memorize and manually key in a number when authenticating. They can copy and paste from one app to the next, or they can take advantage of a biometric option and use thumbprint or facial recognition technology depending on what their device supports. This allowed EagleBank to create meaningful value in the software solution and incentivize migration by offering a superior customer experience.

Preparing for the Rollout

From a policy standpoint, the rollout strategy was clear: new customers moving forward would be onboarded with the EagleBank Soft Token App. To ensure an easy activation process for all, EagleBank took two important practical steps.

- EagleBank created a PDF document that provided a screen-by-screen walkthrough of the activation process to help show users exactly what to expect. This document is available to the customer in several locations. It is linked on the desktop screen where the user begins their activation, and it is also sent in a welcome email that provides some instruction on how to get started. This process met with a positive response. As noted by Barb McCann, VP Electronic Delivery Channel Manager at EagleBank, “Customers have been very receptive. They like the fact that we send them the email and that they can access and turn on their soft token right away.”

- EagleBank also assembled a temporary centralized customer care group to facilitate the rollout. Their responsibility was to field live customer service calls on technical support issues and be a subject matter expert. Their experience could then be used in order to transition callers to EagleBank’s centralized customer support.

Solution 2: Optional Adoption for a Longterm Transition

After consideration, the team at EagleBank decided to allow existing users to keep their hardware authenticators. The strategy is to encourage the widest adoption possible and transition the customer base off the hardware devices over time.

As the hardware reaches the end of its lifespan (each device has a battery life of four to five years) or the customer loses their hardware authenticator, the bank will offer them the software alternative.

EagleBank is also planning to establish a quarterly reminder message for their customer base. The message would be used to raise awareness of the software authentication app and encourage customers who are interested to make the switch.

By following this approach, EagleBank continues to make the transition from hardware to software authentication as simple as possible for its customer base.

In the past when the hard tokens were mailed out, it might average three to four days to get the customer live, and now that can be as little as five minutes.

The Benefits

In the first nine months after launch, 95 percent of new customers signed up to use the software authentication solution. In addition to meeting customer expectations for an easy and convenient authentication experience, EagleBank realized efficiencies in their new process after launch. Most notable is the drastic reduction in time required to onboard new customers.

By offering software authentication, EagleBank is eliminating the slow, manual processes that delay a prospective customer from onboarding and taking advantage of banking services.

The faster a financial institution can empower their customers to begin transacting, the higher the level of customer satisfaction with their new bank.

Finally, EagleBank also retired a handful of print brochures with instructions on how to use the hardware authenticators. With all new customers now using the software solution, these brochures became obsolete.

Conclusion

In choosing a provider, EagleBank looked no further than OneSpan.

“We had already been using OneSpan hardware tokens for 10 years. I wanted our software authentication to be a OneSpan solution, since OneSpan was the solution our customers were already familiar with – and we as a bank were familiar with.”

With the documentation written, support infrastructure in place, and software authentication solution available to the customer base, EagleBank now offers a modern, progressive authentication experience. The bank differentiates with a personal touch as well as the modern conveniences that customers expect.