Executive Summary

Deliver & sign documents in real-time

- Track the progress of your digital transaction in your OneSpan Sign account

- Automatically archive e-signed documents in your OneSpan Sign account for as long as you’d like

- Use and save templates to automate future transactions

Easy to set up

- Get up and running with e-signatures within minutes

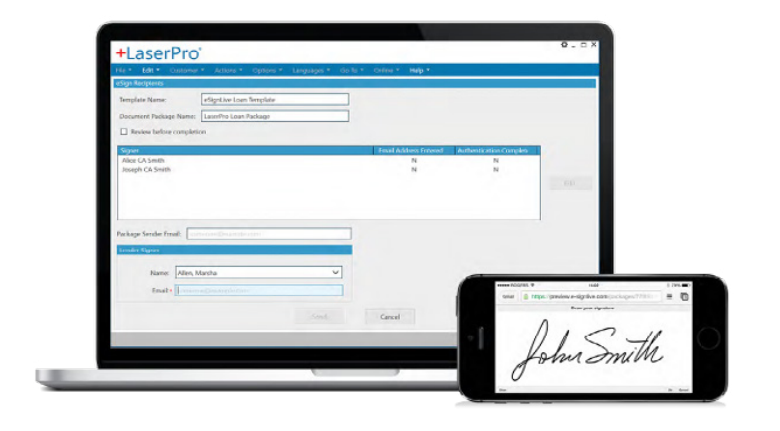

- Send documents for signature from LaserPro with dynamic templates

100% secure and legal

- Multiple authentication options

- Easily prove compliance with the most comprehensive audit trails in the industry

- E-signed documents include embedded audit trails and tamper evident signatures that record who signed, in what order, when and where

LaserPro provides an integrated and seamless way to reduce the preparation time needed for lenders to originate and process a commercial lending transaction. However, to keep the transaction moving smoothly, it is important that the financial institution can obtain legal and secure e-signatures from their borrowers without the hassle of downloading, signing and scanning.

OneSpan Sign for Finastra enables lenders to send loan origination documents to clients for e-signatures directly from LaserPro. This integrated solution streamlines and enhances the loan signing process for financial institutions by eliminating manual errors and reducing costs. With OneSpan Sign’s e-signature ceremony, borrowers can review and sign their loan documents from anywhere, anytime and on any device. By providing an end-to-end digital solution for loan origination, OneSpan Sign for Finastra’s LaserPro ensures that the lender and the signer, both have an effortless and intuitive user experience.

OneSpan Sign for Finastra LaserPro handles many different scenarios, including:

- Managing multiple documents and signers with serial or parallel signing processes

- Choosing from various authentication options like Q&A, SMS or email

- Implementing built-in reminders and expiration dates

- Auto-sending documents once prepared and generated

- Customizing the signer experience across any channel and any device, including mobile

Add e-signatures to all your loan origination documents like:

- Notice of Final Agreement

- Mortgage application

- Promissory Notes

- Authorization Documents

- Credit Disclosures

- Closing Disclosures

- and more...

THE SIGNING PROCESS

1 Select

Select one or more documents for your e-signature request. Workflow allows for configuration with variables.

2 Prepare

Configure your signers, expiration, reminders, and other options on your transaction request.

3 Create and Send

Place signatures and fields into your documents via drag and drop, an autoextraction method, or pre-defined layouts.

4 Track and Archive

Monitor the progress of the transaction and archive the e-signed documents and audit trails back in LaserPro for easy access and tracking.

PRODUCT DIFFERENTIATORS

Most flexible solution

- Configurable workflows and a wide range of user authentication options and signature capture methods

Highest adoption rates

- Fully white-label the e-sign process and deliver the best signer experience — from simple to the most complex workflows

- Ease of use across channels and devices from 20+ years of best practices

Most comprehensive audit trails

- Static and patented visual audit trails make it easy to demonstrate compliance and prove exactly what was signed and how it was signed

Secure, legal and compliant

- Tamper-evident seal for each signature

- One-click, vendor-independent verification of signatures

- OneSpan Sign meets the highest security standards including SOC 2, FedRAMP, and HIPAA