Executive Summary

Business Objectives

- Improve customer experience by enabling the bank’s business clients (and their enduser customers) to e-sign from anywhere on a mobile device.

The Problem

- The bank needed to e-signature-enable two Treasury Management processes very quickly.

The Solution

- The OneSpan Sign cloud service was integrated with the bank’s small business portal in two days.

The Results

- Obtain signed authorizations immediately

- Prevent abandonment

- Improve cash flow for small businesses

- Convenience of location-independent signing

- Easier to do business

It allowed the bank to integrate and go-live quickly, using a single IT resource and a cloud pricing model better suited to lower volume transactions. Because the cloud service is an extension of their existing platform, the bank maintains a consistent and repeatable approach for compliance. And if the volume of e-signed treasury management forms grows, the bank has the flexibility to migrate these processes to their on-premises e-signature solution at any point.

Background

This leading bank began rolling out electronic signatures across all 3,000+ branches in 2011 to automate loan origination and closing. By February 2013, the bank had extended e-signatures to deposit account openings for new and existing customers. Up to this point, all e-signing took place in the branches. However, to make banking easier for business customers, the bank needed to offer e-signatures outside the firewall.

For treasury management processes such as an Automatic Clearing House (ACH) withdrawal out of customers’ accounts, businesses need a convenient way for consumers to sign the bank’s authorization form – from any location, on any mobile device, at any time. By keeping the process digital and making it convenient for consumers to sign on their smartphone, businesses can obtain the signed authorizations faster and prevent abandonment. This improves cash flow, which is critical to the operation of small businesses, and makes it easier for all parties to do business.

Similarly, when business customers want to add a new owner as a signing authority on a corporate account, the existing account holders must all sign the Add New Owner Addendum form. This process can involve dozen of signers and, on paper, can take weeks to complete. By using a contractor to e-signature-enable this process in just two days, the bank was able to provide corporate customers with a significantly better banking experience – at minimal cost and with minimal involvement from their busy IT department.

I was surprised by how quickly we can have e-signatures up and running for customers worldwide. The API documentation makes Integration so simple.

ACH Withdrawal Authorizations

“A typical scenario is a fitness center that wants to have the approval for an ACH withdrawal, to receive monthly payments automatically from their customers’ accounts,” says an executive with the bank. “The traditional process would have been to have a paper form validated on site and eventually sent back to the bank. In the new e-signature process, the fitness center sends their customers an electronic version of the form to fill out online with a mobile device. Once e-signed, the form is sent immediately to the fitness center and bank for processing. It’s less error prone and has faster turnaround.”

While the bank had originally planned to use its onpremises installation of OneSpan Sign Enterprise Plan to capture consumers’ signatures, it was up against a tight deadline. With no time to waste, the bank’s IT team turned to the cloud version of OneSpan Sign. An internal developer built the bank’s user interface and integrated with the mobile-ready OneSpan Sign cloud service in less than a week.

The project included:

- Converting the paper form to an e-form.

- Building a user interface within the bank’s portal so the business customer can prepare and send forms to consumers for e-signature.

- Customizing the email notifications going out to consumers to ensure that the payment process is clear. Rather than use the standard email text provided by OneSpan, the bank rewrote it to better fit this use case. For example, the email states that the business (e.g., fitness center or other) requires the consumer to sign the bank’s Payment Authorization form. The email also mentions that the bank is using a third-party e-sign service and that the consumer will be redirected to that service. Such clear instructions build the consumer’s trust in the e-sign process and eliminate any confusion about being routed to OneSpan Sign instead of the bank.

- Integrating with the e-signature service so the form gets handed off from the bank’s portal directly to OneSpan Sign to manage all the signature capture and the collection of electronic evidence.

- Enabling extraction and export via XML to automatically push the customer data captured in the form to the bank’s Payment Authorization Manager system. Now that the form is automated, a business employee logs in to the bank’s portal, enters the consumer’s name and email address and clicks “SEND FOR SIGNATURE.” OneSpan Sign immediately sends the consumer an email inviting him/her to e-sign the form.

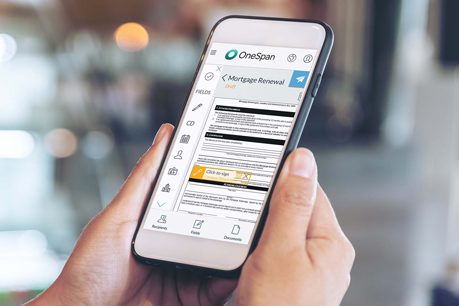

Using any web-enabled mobile device or computer from their home, office or any other location, the consumer clicks the link in the email, authenticates him/herself by answering two secret questions, and a browser opens displaying the form. Some of the consumer’s personal information is already populated and the consumer completes any outstanding text fields. A yellow SIGN HERE tab indicates where to click-to-sign. The whole process now takes approximately five minutes – rather than dragging on for days or weeks.

The bank was able to provide corporate customers with a significantly better banking experience – at minimal cost and with minimal involvement from their busy IT department.

Add New Owner Process

When a business brings on a new owner, the bank requires the other business owners to sign a form giving the new owner signing authority on the account. The bank digitized this form and made it available on their small business portal as a self-serve process.

Any existing business owner can now initiate the process by logging in to the portal, selecting the e-form and entering each co-owner’s name and email address.

- OneSpan Sign then sends an email notification to each signer and enforces the workflow so the new owner e-signs last.

- On the back end, the bank’s portal calls into an abstraction layer that in turn calls OneSpan Sign.

- This triggers the e-sign transaction.

- Once completed, the e-signed documents automatically flow to the bank’s enterprise archiving system.

The bank hired a contractor and provided him the OneSpan Sign API and documentation, complete with API queries. The documentation enabled the contractor to get signing sessions up and running in just two days – closing the project significantly under budget and ahead of schedule.

Conclusion

OneSpan Sign Enterprise Plan makes it easy to add e-signatures to any process where a document is generated for signature. With the OneSpan Sign SDK, code samples and free sandbox account, developers can integrate e-signatures in websites, applications and enterprise systems in just hours – using either an in-house IT resource or a contractor.

Access the Online Integrator’s Manual

We pride ourselves on providing you with the best tools, examples and documentation in the industry. The main chapters are:

- Resources – Links to our Developer Resources page, including our SandBox signup and login.

- Getting Started – Briefly describes the system, its components, and how to connect to our servers.

- Topic-Specific Guides – Introduces the SDK’s functionalities one feature at a time.

- OneSpan Sign SDKs – A section of downloadable resources for various runtime SDKs.

- Branding and Customization – A guide to branding and customizing the look and feel of the Signing Ceremony.

- Reference Materials – A set of reference materials for the REST API, together with a Glossary.