Executive Summary

Business Objectives

- Digitize the commercial lending process to focus on growth and serving business members

The Problem

- Limited resources and needed the right technology to improve efficiency and maximize bandwidth

The Solution

- Cloud-based nCino Bank Operating System integrated with OneSpan Sign

Results

- WPCU increased loan capacity from $5M to over $15M, grew volume from 30 to over 100 loans/month

- Lenders save ~50 minutes per loan

- A large number of loans under $20,000 are closed using e-signature; 30% of transactions over $250,000 use e-signature

- Members love the convenience

- Compliance team was very satisfied with the audit trail and document security features

WPCU also serves the business community through their Member Business Services (MBS) department. By year-end 2017, the credit union’s business loan portfolio totaled nearly $190M. Just a year prior, the department’s 15-person Commercial Lending team had closed $74M in loans, at the time considered their highest production on record.

The ability to grow so rapidly in today’s competitive commercial lending sector is a testament to the credit union’s role as trusted partner to the business community – backed by investments in digitization and technology. At WPCU, Commercial Portfolio Analyst Benjamin Miller credits the nCino Bank Operating System with transforming their commercial lending processes.

But it wasn’t until the credit union leveraged the e-signature integration between OneSpan Sign and nCino that the Commercial Lending team was truly able to harness the efficiencies of an end-to-end digital process. In less than one year using the combined cloud solution, WPCU has tripled commercial loan volume from 30 to 100 loans per month with the same core team, while also streamlining the lending experience for their business members.

At Wright-Patt, we have a lot of opportunity to set up servers and store our data on-prem. Sometimes it’s more cost beneficial to have everything in-house, but with nCino, it just made more sense from a price standpoint to leverage the cloud.

The Challenge

While the Commercial Lending department had traditionally focused on serving small businesses, leadership also saw growth opportunities in a new segment: mid-market business customers.

The challenge was bandwidth. The commercial team was limited in resources and any growth would have to happen with the existing team of 15 people.

To maximize efficiency and free up time to serve the midmarket, the team needed to eliminate time-consuming paper processing. That meant finding the right technology to digitize their commercial lending processes end-to-end.

The Solution

WPCU took the first step to going digital by selecting the nCino Bank Operating System in December 2015. The system was implemented and operational within six months.

“It is one of the most significant cloud-based systems we’re using. nCino was the best fit for our Commercial Lending Department in terms of our production levels and growth opportunities,” Miller says.

“Compared to other vendors we evaluated, we found that nCino offered the best data analytics and reporting. Being a cloud system, it was easily deployed. We didn’t have to set up storage on our end, which obviously was a plus.

At Wright-Patt, we have a lot of opportunity to set up servers and store our data on-prem. Sometimes it’s more cost beneficial to have everything in-house, but with nCino, it just made more sense from a price standpoint to leverage the cloud.”

WPCU saw an immediate impact on the business. The efficiency gains freed up enough capacity so the commercial lending team could take on volume in the mid-market sector. “In the past, our sweet spot has really been the small business segment. As an example, a business member who comes in for a $20,000 auto loan. We were doing a lot of those. But once we added nCino, the efficiency gains of getting off paper gave bandwidth back to our personnel to do more loans – and larger loans.”

“Still Not Paperless”

Despite the initial efficiency gains, however, the Commercial Lending team was still falling back to paper to capture signatures on the final loan contracts. That injected unnecessary manual work back into the process.

“We thought we could take on the additional capacity, and continue to manually produce our own documents and have people come into the office to do wet signatures. When we went from 30 to 100 loans per month, it was not possible – especially with the same core team. It just did not make sense anymore,” Miller says.

“Up to that point, we had not recognized the need for e-signature. But within six to nine months of deploying nCino, we did. It became obvious that the final piece of the transaction is having the ability to electronically sign the documents so the commercial lender does not physically have to go on-location. As an example, if one of our commercial lenders needs to go to Cincinnati to meet a member, that’s a one-hour drive. It doesn’t make sense to do that, to get a signature for a $5,000 credit card. We needed the electronic signature capability, especially for smaller transactions.”

“Of course, there are times when it’s best to have that personal touch of going out to meet the member in person to sign the documents. But sometimes the business member is extremely busy and they want the freedom and ease of signing electronically.”

The Switch To nCino’s Integrated E-Sign Partner

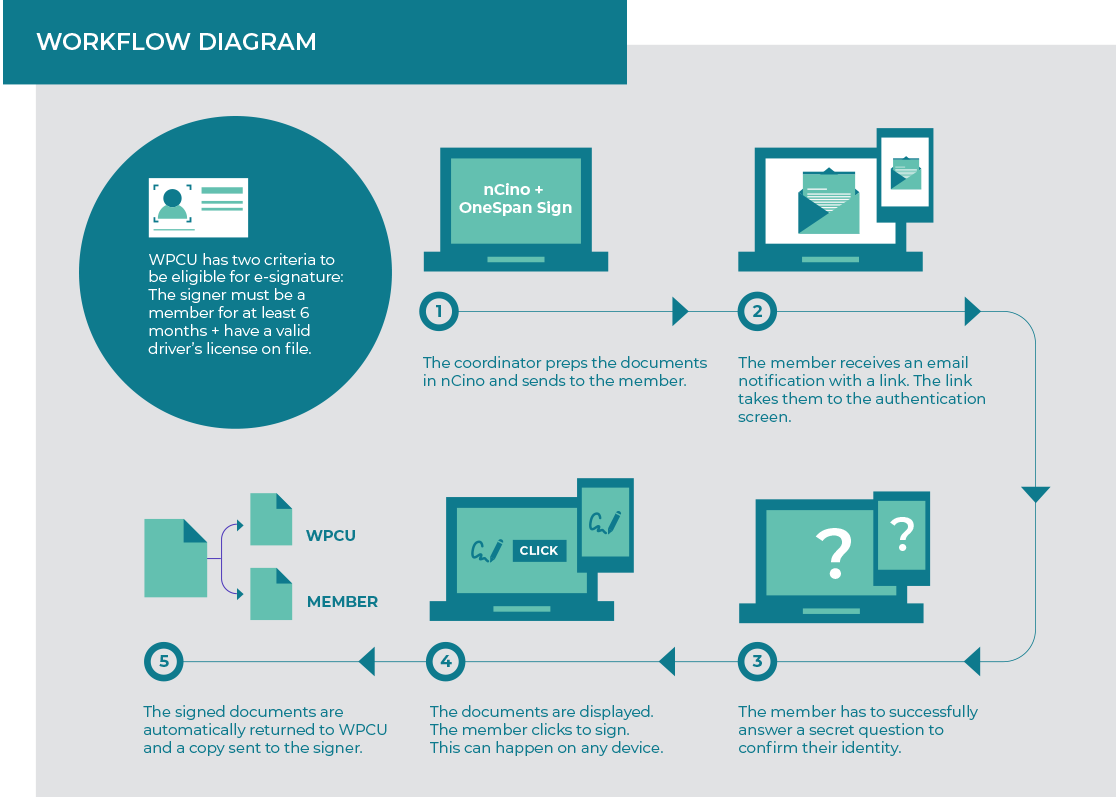

When Miller realized there was an integration available with OneSpan Sign, he knew the integration would offload all of the unnecessary tasks weighing down the team.

The new functionality was seamless. The coordinators, who prepare the digital loan packages, were able to send out the loan contracts without having to add signature boxes.

“With OneSpan Sign, we didn’t have to set up all the documents manually. OneSpan Sign was a big improvement because it’s just much more efficient if we can do everything right in nCino. We also want to make sure that when we send documents electronically, we can leverage what is already populated in nCino. We already have the contact information, phone numbers, email and physical address of all members who are a party to the loan. Since all this information is already in nCino, we need be able to leverage that when capturing signatures.”

Key Benefits

- Improved member experience: According to Miller, “Our customers are really excited to have the opportunity to electronically sign anything, especially as part of smaller transactions. If I could offer advice to other credit unions, I’d say bring in e-signature because it is such an ease-of-use and convenience benefit for the member. Anything that can help better the member’s experience helps better the relationship with our members.”

Miller also sees business members wanting to transact more on mobile devices over time. “The mobile support is exciting because members are always asking, ‘Hey, can I just sign this on my phone somehow?’ For the moment, I would say the mobile requests we receive are primarily for small credit card transactions – like the $5,000 credit card use case – where we’re basically having them sign a credit card agreement and sometimes a guarantee for those types of transactions. But I could see that changing over time.”

- Increased loan capacity: “In the last two years, we have increased our capacity of lending per borrower from $5M to $15M. We’ve had a shift in what we can process on a monthly basis. We were processing 30 - 40 loans a month. Now, for several months running, we’ve had 100 loans in production in a month. Our volume and production is through the roof from a dollar standpoint, with the same core team. That’s from all of the efficiency gains we’ve had through the nCino Bank Operating System.”

The integrated solution is easy to use and has improved loan processing time for our members.

- Time savings for staff: “Our coordinators, the ones who put together the document packages and send them out electronically, get the most excited about it.” Where they used to spend 22 minutes preparing paperwork for signing by the member, they have now cut that time by 50% with the digital process. Lenders have also seen significant time savings. On paper, lenders would spend on average 54 minutes conducting a loan closing “that now takes no time at all on their part”, says Miller.

- Security and compliance: “The OneSpan Sign audit trail capability is great. There is a tamper-seal on each document. We also like how there is an audit trail for each loan, and how each screen is recorded in the audit trail with the time stamp. Plus, all the signatures are embedded in the PDF document. All of those protect both the member and our credit union. Our compliance department was very satisfied when we viewed that with them.”

Conclusion

In 2017, WPCU’s Commercial Lending team processed over 650 business loans – an increase of 65% over the previous year. For every additional loan that the team can process because they are no longer spending their time printing, scanning, faxing, distributing and archiving paper, the credit union becomes a stronger supporter of their local economy.

“As WPCU expands its business services portfolio, our ability to positively impact the community will increase along with the financial returns to credit union members. We are still a little engine within this $4 billion credit union, but the business program has an outsized impact on our bottom line performance,” says Scott Everett, VP Member Business Services.

The partnership between nCino and OneSpan provides credit unions of all sizes with the foundation for digital transformation, growth, and most important, a modern member experience. In addition to best-of-breed cloud solutions and expert guidance, we also work closely with industry associations such as the Credit Union National Association (CUNA) Strategic Services, where OneSpan is the exclusive e-signature partner. For advice on how to digitize commercial lending at your credit union, visit OneSpan.com.