Safeguard digital accounts and secure financial transactions

OneSpan’s market-leading strong authentication, mobile application security, and threat detection solutions protect over 300 million end-points globally.

Trusted by:

The widest range of user authentication, digital transaction security, and mobile app shielding solutions.

Designed for the banking industry and beyond.

VISION FX: A breakthrough innovation in digital banking security

Prevent threats like social engineering, account takeover, and adversary-in-the-middle attacks before they affect your customers.

VISION FX is a breakthrough innovation in phishing-resistant transaction security. It combines FIDO2 protocols with the unique security features of our CRONTO® transaction signing technology.

Merging both technologies into a single authentication solution delivers the most secure, user-friendly, and future-proof option on the market for two key use cases: account login and transaction authorization.

Digital banking authentication & transaction data signing

As a proven leader in authentication solutions for digital banking, we have deep expertise in both user authentication and transaction authentication (also known as transaction data signing or dynamic linking).

Millions of financial transactions annually are secured by our CRONTO technology in compliance with regulations like PSD2. CRONTO creates a transaction signature unique to each transaction to preserve data integrity and ensure authenticity. Just as important, users tell us it’s the easiest and fastest to use.

Mobile app shielding

Robust security is essential for any mobile app that carries Personal Identifiable Information (PII), or other sensitive and confidential information – especially related to banking and payments, or business operations.

Mobile app shielding protects mobile apps against sophisticated malware, mobile banking Trojans, overlay attacks, and many other mobile threats. Insulate your mobile app so it can operate securely even in potentially hostile environments, such as jailbroken Android and iOS devices.

Workforce authentication for all industry sectors

To protect against increasingly sophisticated social engineering attacks, credential theft, and account takeover, organizations need strong employee authentication that is easy to use.

Now you can eliminate passwords and simplify the remote login experience with phishing-resistant DIGIPASS FX authenticators based on FIDO standards.

See how customers in financial services use our products

BBVA

BBVA uses OneSpan’s CRONTO devices to protect corporate clients against social engineering attacks. Clients like the ease of use. Now it’s faster and easier to securely authorize transactions.

SMBC

SMBC has been using OneSpan’s authenticators for >10 years. To make online banking more accessible for visually impaired customers, the bank implemented Digipass Comfort Voice.

Eaglebank

EagleBank offers clients a choice of hardware or software authentication. By partnering with OneSpan, the bank can meet all of their clients’ preferences, boosting customer satisfaction.

Sony Bank

Having the ability to fully secure the Sony Bank App gave the bank the confidence to move forward with new mobile services. Learn how OneSpan's App Shielding protects the app.

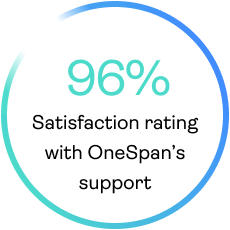

What our clients say

Additional resources

Blog

2024: The age of a workforce free from passwords

Blog

What is new in NIS2 and who does it apply to?

Blog

Strengthening the financial sector through authentication and regulation

Blog

Why hardware devices are key to banks’ strong customer authentication strategy

PODCAST

Why FIDO is the future of authentication

WEBCAST

PSD3 regulations & strong customer authentication