3 Mobile Challenges the Insurance Industry Needs to Overcome

The insurance industry is shifting its business model to digital and mobile first. Insurance companies no longer rely solely on traditional channels such as agents and brokers to reach consumers. They have developed new, alternate channels to drive growth and tap into today’s digitally savvy consumer, who now expect the same intuitive experience from their insurance carriers as they do from their favorite mobile app. Even insurance agents are demanding better digital and mobile capabilities from insurers to increase their ease of doing business.

As a result, carriers are moving to an omnichannel experience where transactions can be completed end-to-end in the customer’s preferred channel. Increasingly, that's the mobile channel.

Mobile: An Underutilized Channel in Insurance

The use of mobile devices across the globe is at an all-time high. In many industries, mobile has become THE central access point for digital transactions because it provides a level of freedom and flexibility that wasn’t available just a little over decade ago. The beauty of mobile is that it allows us to complete transactions from anywhere – at home, in the office, or in transit.

Unfortunately, too many insurers are not fully using their mobile channel. The life insurance industry in particular trails in mobile maturity compared to its property and casualty (P&C) insurance industry counterpart. That’s partially because life insurers have to deal with more distribution channels, client engagement models, and legacy technologies that affect the rate at which new mobile strategies can be adopted. As a result, to remain competitive and win a larger share of the customer’s wallet, life insurers must adjust their business and service models. If they are unable to adapt to the fast pace of digital change, they risk losing ground to more agile and innovative players that continue to surface.

In addition, from a mobile app perspective, many of the insurance apps available in the marketplace today simply don’t provide adequate mobile and customer service capabilities. Case in point: In the Aite Group’s "Mobile Apps in Life Insurance: An Underutilized Channel" report, senior analyst Samantha Chow outlines that less than 20% of the top 50 life insurance carriers have a mobile app for their life insurance policy holders. Insurers that do offer a mobile app, "have done so in a half-baked attempt at checking the box that says ‘mobile app done’ without providing any value to the consumer or the life insurance carrier."

For mobile-first consumers, this translates into a frustrating experience because the lack of feature-rich mobile capabilities forces them to use another channel (i.e., online portal or call center) to complete the desired action.

Mobile Challenges (And Opportunities)

The Aite Group report points out the key challenges that the insurance industry is facing when it comes to mobile. Overcoming these challenges is critical to executing an effective mobile strategy. They include:

- E-Signatures: Capturing legal intent and automating workflows for businesses processes such as new policy applications and the acceptance of account and beneficiary changes.

- Audit Trails: Capturing a detailed log with respect to the transaction – e.g., who signed, in what order, when and where – to demonstrate compliance for audit reasons and to defend against legal disputes, should they occur.

- Mobile App Security: Authenticating users and securing the mobile app itself (and the underlying data and digital transactions) to proactively protect against attackers.

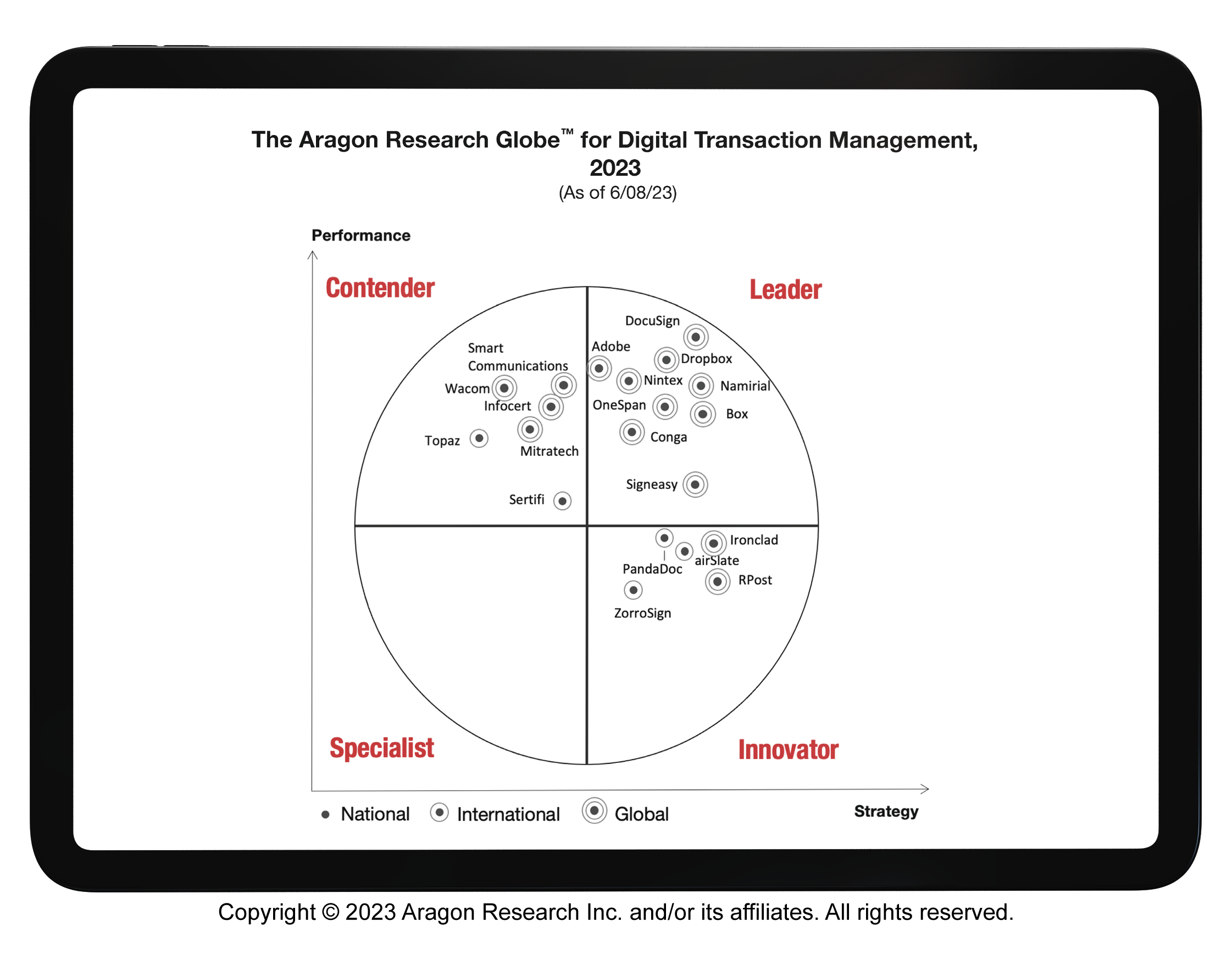

As you continue to build out your mobile strategy and evaluate solutions in the market, look for vendors that can meet all of these mobile requirements. OneSpan Sign is a best-in-class e-signature solution for all your e-signature, audit trail, and mobile app security needs. Our solution is used by some of the top banks and insurance companies in North America across multiple channels – online, mobile, call center and face-to-face engagements via agents, brokers, and advisors.

Our broader product portfolio also consists of a mobile app shielding solution to support the stringent security requirements from your IT and security teams. The solution leverages runtime application self-protection (RASP) technology to guarantee the integrity of your mobile app and protect the underlying consumer data and digital transactions from fraudsters. RASP essentially wraps around your mobile app’s code to create a "shield" against foreign code injection.

Mobile: Not Just Another Sales Channel

This blog post has focused primarily on mobile apps in insurance. But an effective mobile channel strategy involves more than just a mobile app for consumers. Mobile is a new way of solving traditional challenges in the insurance industry. For example, insurance agents in the field can engage with their clients and complete transactions in real-time using a tablet. The bottom line is that mobile shouldn’t be thought of as just another sales channel; it is an engagement channel because its goal is to increase customer interaction and loyalty, and decrease churn rates.

If your mobile experience includes paper and pen-and-ink signatures at any point during the transaction, it isn’t a fully digital one. As insurance carriers increasingly embrace improving the total customer experience as part of their digital transformation projects, mobile is naturally moving up in priority and the ability to engage clients via mobile is now considered a requirement in order to create an omnichannel experience for consumers.

Visit our insurance industry page to learn more about how OneSpan Sign has been helping insurance carriers and agents deliver a better, digital experience since 2004.