Why insurers need easy eSignature processes

Consumers expect easy digital experiences with their insurance carriers. They want simple user interfaces, clear directions, and quick online approvals.

Deploying integrated digital agreements and electronic signature solutions helps property and casualty insurance carriers offer better experiences for their prospective customers and the insured.

To understand what an easy signing experience means for insurance stakeholders and why it’s critical, we teamed up with Glenn Rothenberg, Principal at RedMountain Advisors, a consulting firm that provides advisory services to insurtech companies.

Together, we interviewed stakeholders across the industry -- from Chief Underwriters to Heads of Customer Experience, Operations, and IT -- to understand ease of use from an insurance perspective. We asked questions such as:

- What does easy look like when moving from paper to digital agreements within an insurance company?

- What does easy mean to insurance agents, brokers, and advisors?

- And most importantly, what does easy look like for customers?

What we found is “easy” benefits customers and P&C insurance carriers alike, unlocking revenue and winning long-term clients.

Why you should digitize insurance processes

With the increased use of digitization, customers expect more from their insurance providers. But as we spoke with stakeholders who are modernizing their digital customer journeys, we realized this goes beyond premium service.

What we learned is, "easy" is all about technology providing additional ways for you to interact with your customer in the way that they want to interact with you. We also saw growing interest in immersive digital environments that give insurance professionals the opportunity to interact with customers in new ways.

“Easy is all about technology providing additional ways for you to interact with your customer in the way they want to interact with you.”

- Glenn Rothenberg

To put this into context, it helps to look at the evolution of digital customer interactions in insurance. Most insurance businesses start by replacing in-person signing with a remote, self-serve process. To do that, they add eSignature capability to PDF documents. However, with so much happening remotely, insurers are finding that simply using eSignature software to sign documents doesn’t really provide a digital experience.

Carriers are looking to the next level -- how to use dynamic forms with intelligent, guided workflows. For example, an eSignature solution that is integrated with a smart forms solution can smooth the process, eliminate a lot of steps, and ease the customer experience filling in data.

Take the beneficiary change form. An analysis of this process revealed six placeholders for signatures and 26 potential points of failure related to instructions on how to complete the process. Imagine how much more intuitive that could be with guided workflows.

Insurance providers need an electronic signature solution that is flexible enough to meet customers' document signing needs and that can grow with the organization as those needs change.

Rothenberg offered the following advice to insurance carriers, “This is [newer] technology, so don’t get discouraged if you’re not bleeding-edge. Look at it as an evolution, not a revolution. You are going to have different use cases and you want to match the right technology and approach to each.”

“If you have advisors or an agency force that does business over the phone, then remote signing is the baseline (there are very few in-person signings). That’s an opportunity to add virtual signing with videoconferencing,” Rothenberg explains.

“But also recognize that in some claims situations, you might have a customer who chooses to print off a piece of paper, take a picture of it with their phone, and send that in. From a customer service perspective, you want to be able to offer that kind of flexibility to support customers’ individual preferences.”

What does an easy signing experience look like for customers?

When it comes to ease of use, you know it when you see it. And as Glenn says: “You definitely know it when it’s not there!”

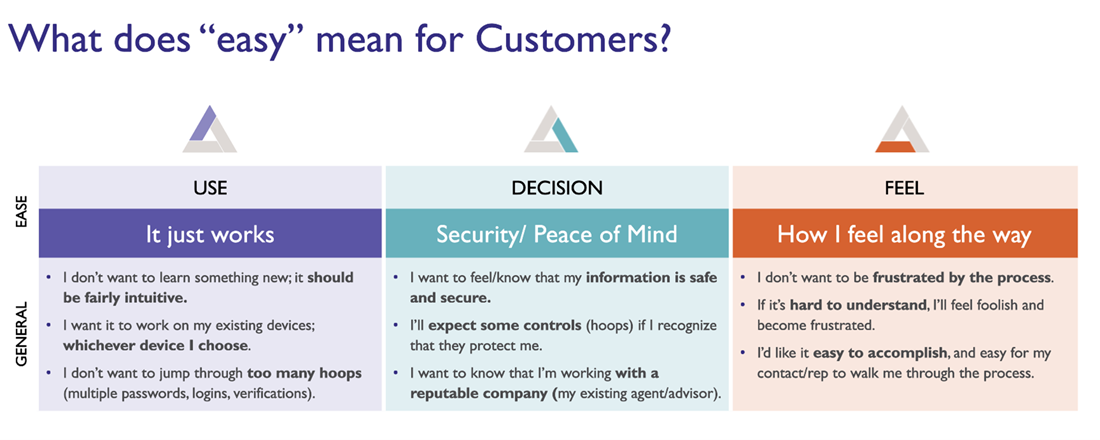

The concept can be broken down into 3 elements:

- Use: How easy is it to use? Does it work as expected? People often don’t want to have to learn something new. It should be fairly intuitive and work on any of their devices. The signature requests, signing workflow, and functionality should feel deeply familiar to the signer. If it requires learning an entirely new system and references to an FAQ for simple processes like accessing templates or uploading documents, then it’s too complicated.

- Decision: Does the digital signing experience provide a sense of security and/or peace of mind? You want your customers to come away from the signing experience knowing they made the right choice in selecting you as their insurance provider. If there’s friction or they struggle with clunky authentication or something goes wrong, they may wonder if they made the right choice.

- Feel: How did the customer feel about the whole experience? Was it frustrating or did the customer walk away appreciating how easy it is to do business with you? Was the whole experience mindful of the customer’s needs? A positive customer experience will leave them feeling understood. Happy insurance customers are more likely to buy more coverage, remain loyal over the years, and tell others about it.

What does easy look like for agents, brokers, and advisors?

Let’s also consider how insurance agents think about electronic signatures. It must be intuitive for the insurance agent, broker, or advisor – whether they are signing agency documents such as onboarding documentation, NDAs, and legal documents, or policy paperwork with clients.

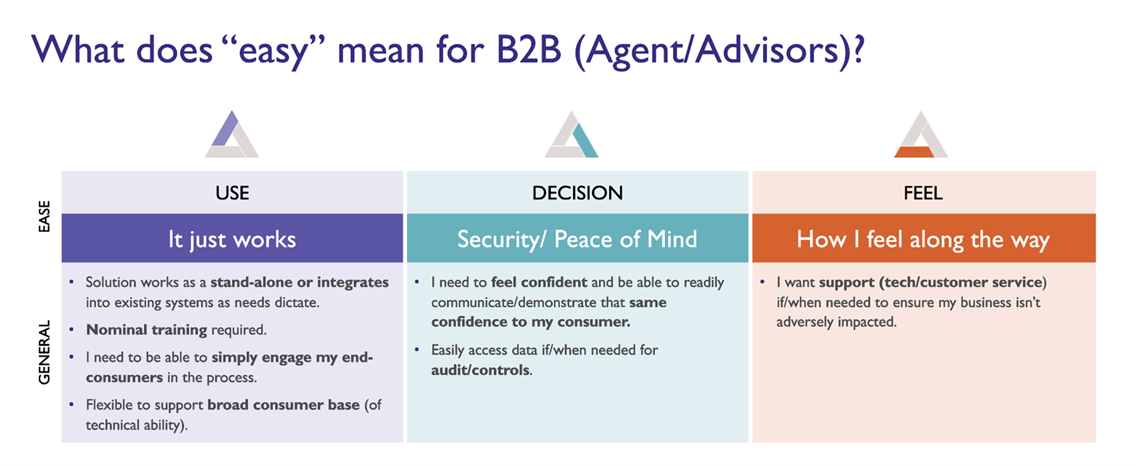

An easy experience for agents, brokers, and advisors can be broken down into the same three core elements customers have.

- Use: Is the solution flexible and easy to use for people at all technical levels? First, as you look to support reps in the field, keep in mind that agents work with different systems, so it’s important to offer them the flexibility to use signature software in a standalone capacity as well as to integrate into the systems and tools they are already using. Signature software should work with nominal training. It should also be simple enough for an agent to be able to offer it to consumers at all technical levels – people who are comfortable with technology as well as those who are not.

- Decision: Does the agent feel confident and secure about the process? Ease of use will inspire confidence in the agent, so they can show their customers how to eSign and guide them through the process quickly. There must be minimal instructions and the agent should feel empowered to lead the process on their own.

- Feel: Is there ample support when it's needed? Agents need the appropriate tech support. Quality, responsive technical support will provide peace of mind that their business won’t be adversely impacted when technical issues arise.

In addition to these three elements, agents need to see tangible benefits from using eSignatures. For example, eSignature apps should streamline the application process by reducing callbacks and write-backs. The solution’s automation and workflow rules can eliminate not-in-good-order (NIGO) documents or incomplete applications, such as when a signature is missing. It should cut down on missing or incorrect information in PDF documents while also reducing the number of back-and-forth emails and phone calls.

Build trust with security that’s easy for all

While there are many security features that build trust in the online signing process, such as digital signature encryption, there are three essential capabilities each insurance agency should consider. These are: white labeling, identification and authentication, and audit trails.

Use white labeling to instill confidence and trust with customers

We found that using a white labeled signature app improves confidence and conversions. We recommend looking for custom branding options that feature your company’s name, logo, and colors in both the UI and notifications.

You don’t want an unknown brand popping up in the middle of the eSignature process. White labeling creates a trusted experience between you and your customer, protects your brand, customers, and agents, and helps to achieve the highest completion rates possible. One insurer saw a 23% increase in application completion rates in just 30 days.

Implement identity verification and authentication

Being asked for identity verification or authentication before eSigning, whether through SMS, email, FIDO passkeys, or other, gives everyone involved peace of mind. This step is essential to confirm the right people get access to the signing session. However, it’s important to avoid any extra unnecessary steps in the process, such as multiple passwords, logins, or verifications, to provide a smooth user experience.

The Co-operators uses a multi-step authentication process. Their spokesperson Leonard Sharman says, "Clients can log in using a unique code provided to them by their advisor, and can ‘click’ online to accept. We are confident that our multi-step authentication process provides an appropriate level of security."

One of the ways The Co-operators is growing their business is by simplifying the purchase of insurance through the company’s advisors. Agents complete and eSign the insurance application form from the convenience of their home or location of choice, finalizing the sale in a single meeting.

Alec Blundell, Vice-President, Individual Life Insurance at The Co-operators says, "Our goal is to make it as easy as possible for clients to do business with us, and providing the option of electronic signatures is one way we’re doing that."

Easily keep and access records for audits

Agents need to be able to access their signed docs for audits, quickly and easily.

Of this, Leonard Sharman said, “For each signed agreement, documents are inextricably linked to the associated signing ceremony data and retained securely in an electronic recordkeeping system. System controls render the combined data and document packages as tamper-proof by restricting any modifications, updates, or edits. Audit trails and logging are in place to monitor access to the data.”

Modernize your customers' digital journey

As the world becomes increasingly digital, your customers and insurance brokers want an easy, secure process to sign documents. This can be modernized through eSignature solutions, which provide an easy, secure way to support customers in their insurance journey, both in person and online.