Securing identity in the age of agentic commerce

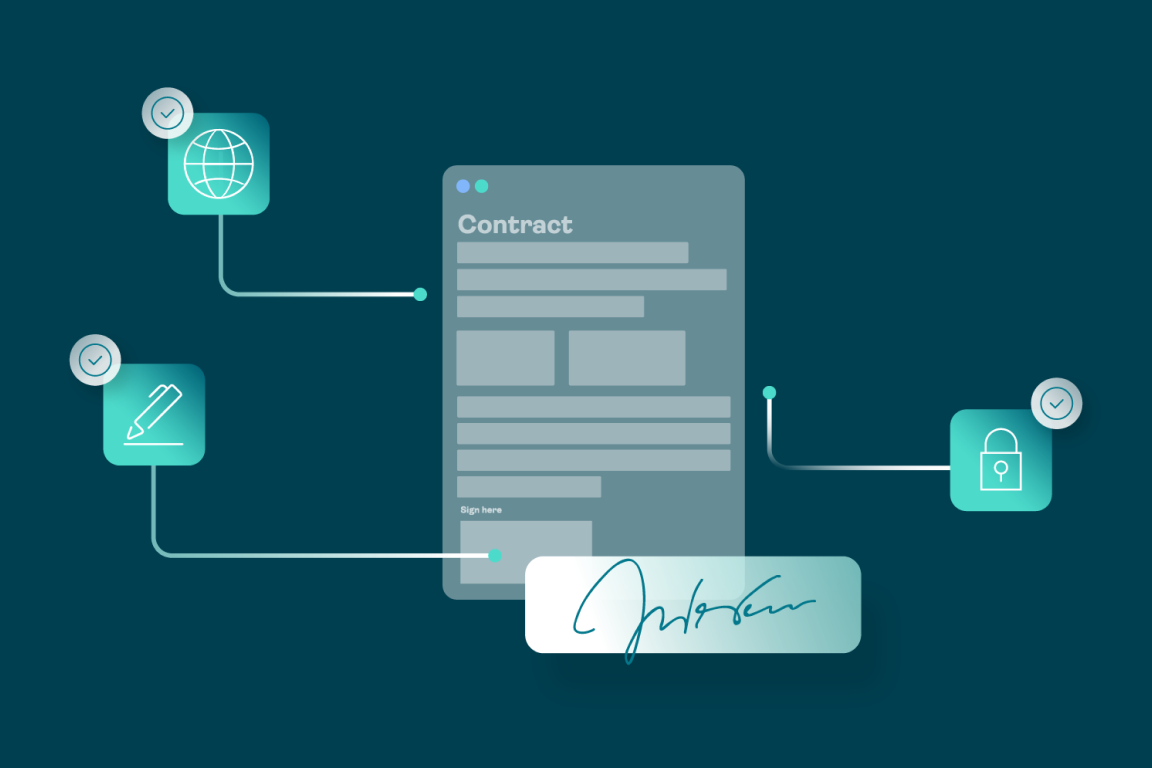

eSignature security tip: How to protect your signing URLs against cyberattacks

AI Answers and Dashboards for smarter digital transaction management

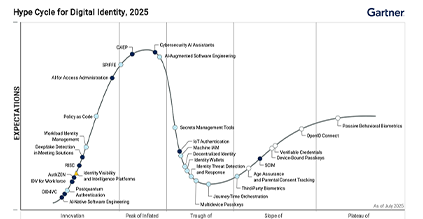

FIDO Authenticate 2025: What I learned about passkeys at scale

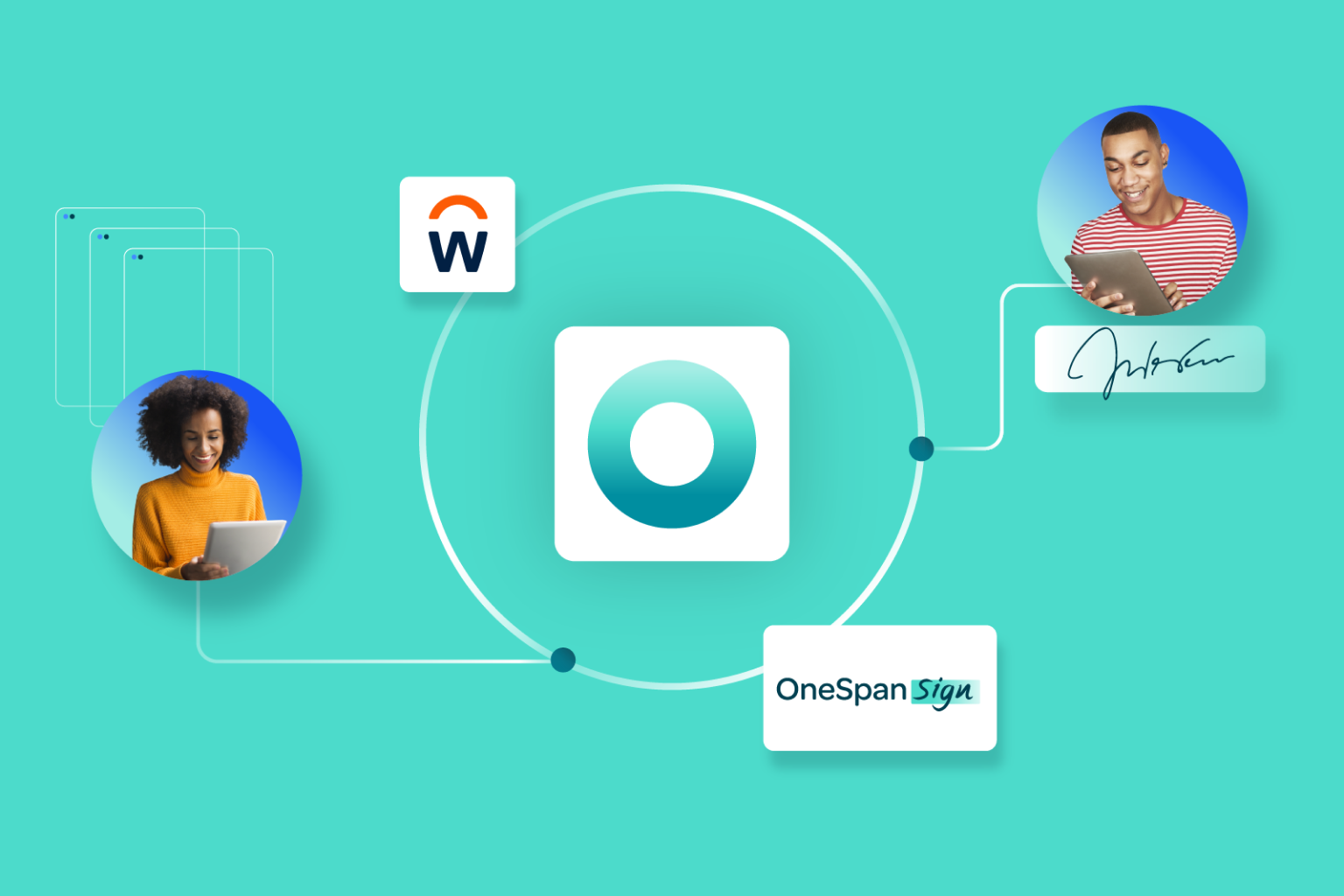

How CURE Auto Insurance digitized with OneSpan Sign for Guidewire InsuranceNow

How we automated HR processes with our own eSignature software

Digipass FX2: The phishing-resistant future of banking security