Device-bound passkeys: Bolstering workforce authentication

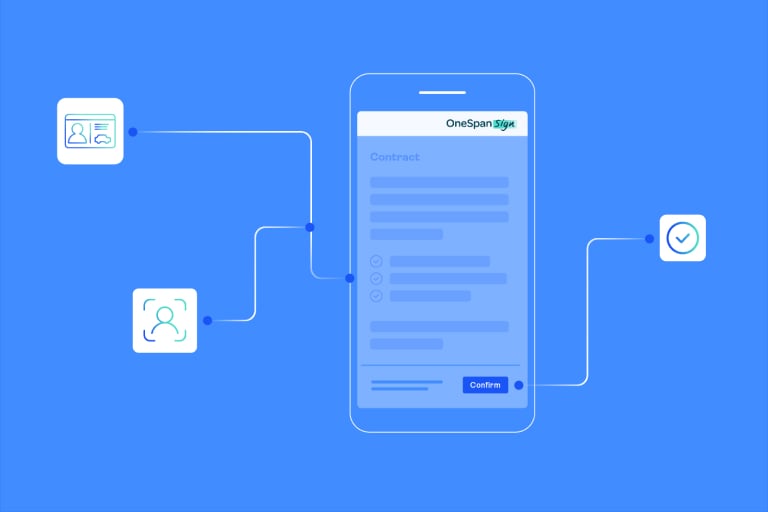

Why insurers need easy eSignature processes

eSignature authentication methods: Strike the right balance with secure, user-friendly authentication

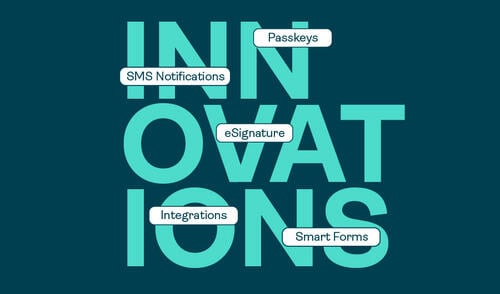

OneSpan digital agreements: New innovations and enhancements in H1 2025

Decoding authorised push payment fraud regulations: A global overview for banks

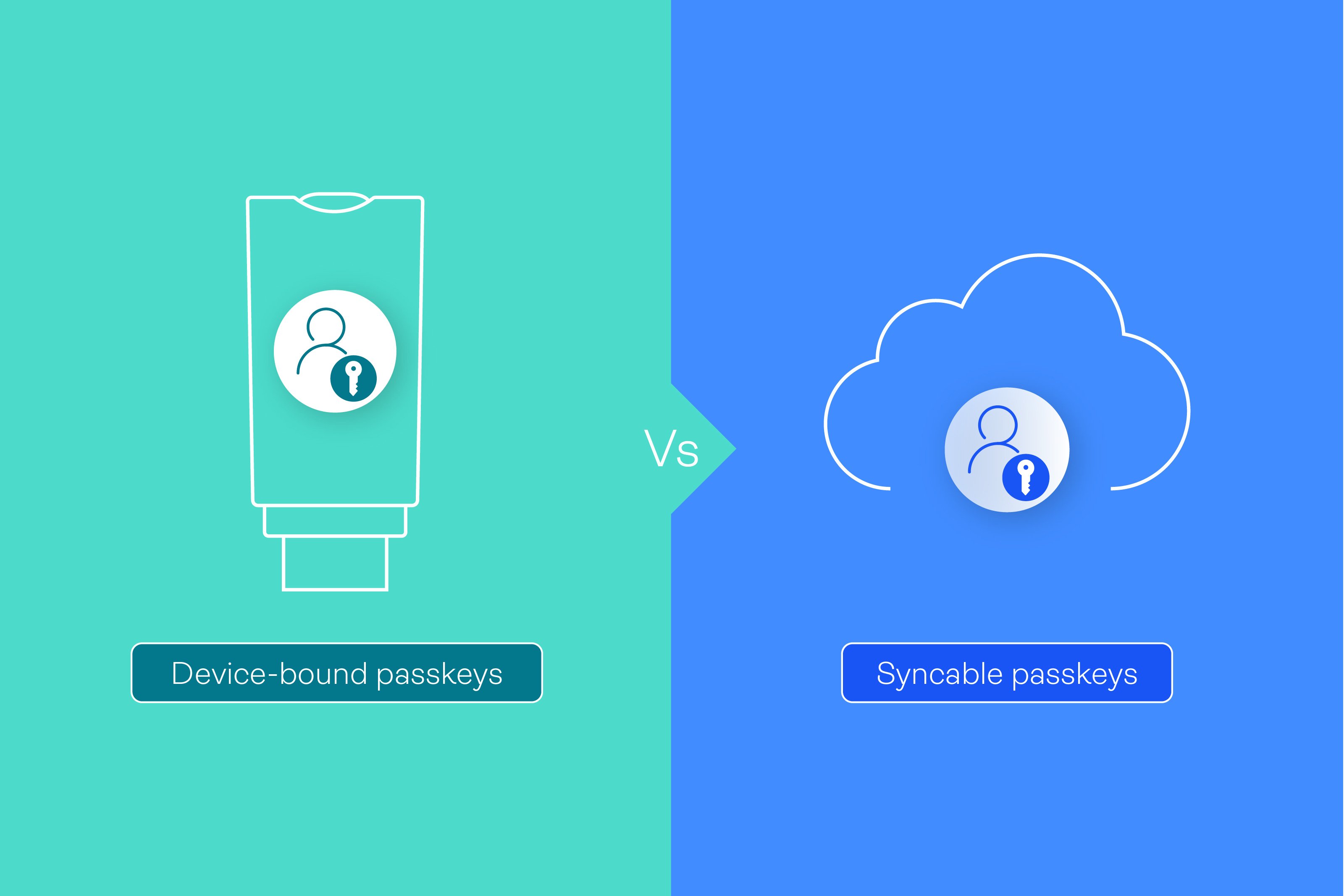

Modernizing signer authentication: The case for passkeys

Center of excellence: What is it and why create one?